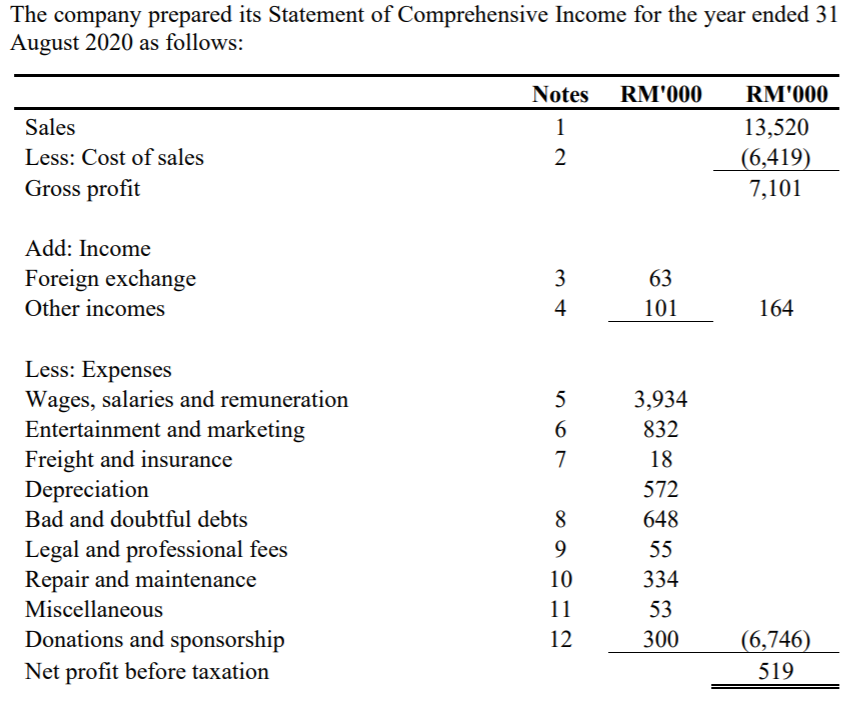

72018 Date Of Publication. Type and Rate.

Capital Allowance Calculation Malaysia With Examples Sql Account

IA AA Industrial buildings.

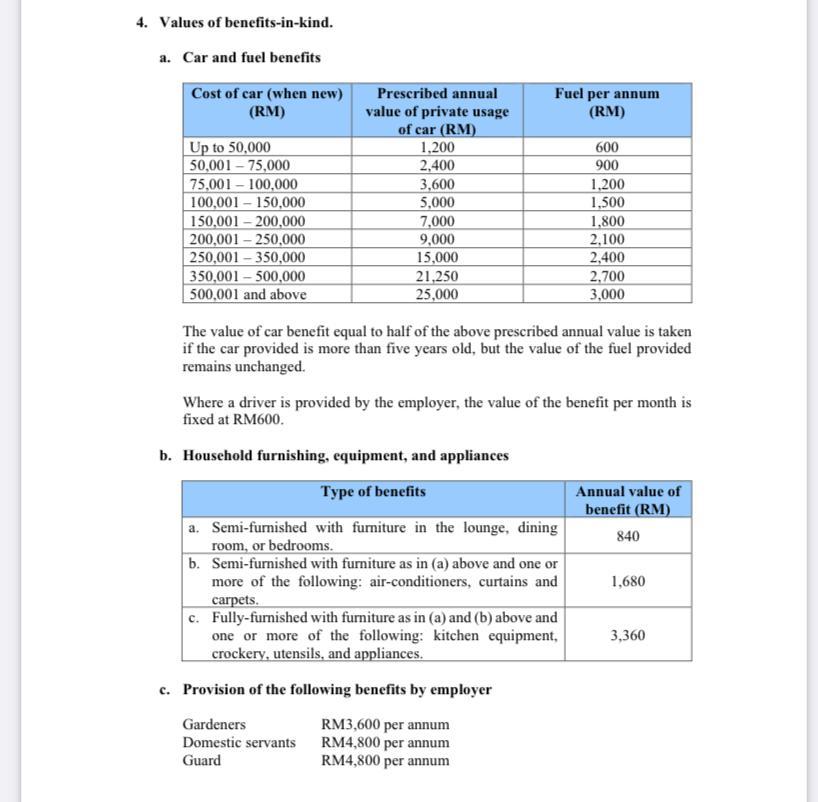

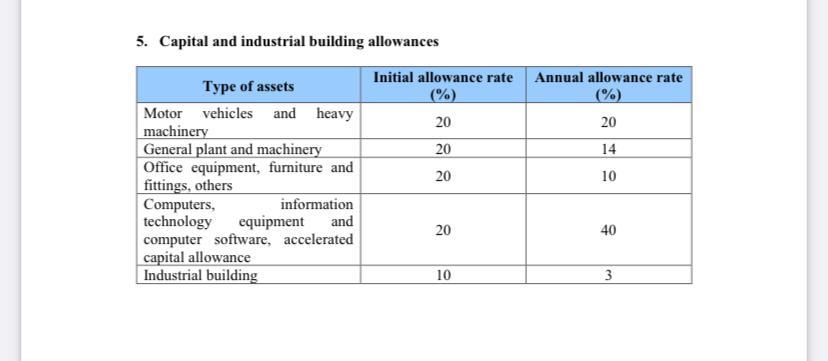

. Example of assets which qualify for accelerated capital allowance rates. IA is fixed at the rate of 20 based on the original cost of the asset at the time. Real Property Gains Tax.

A special rate may be granted by the Director of General for claiming capital allowance of the qualifying capital expenditure incurred. We provide a detailed capital allowances study report segregating total capital expenditure between qualifying and non-qualifying the corresponding capital allowances rates. Accelerated capital allowance ACA for the purchase of machinery and equipment.

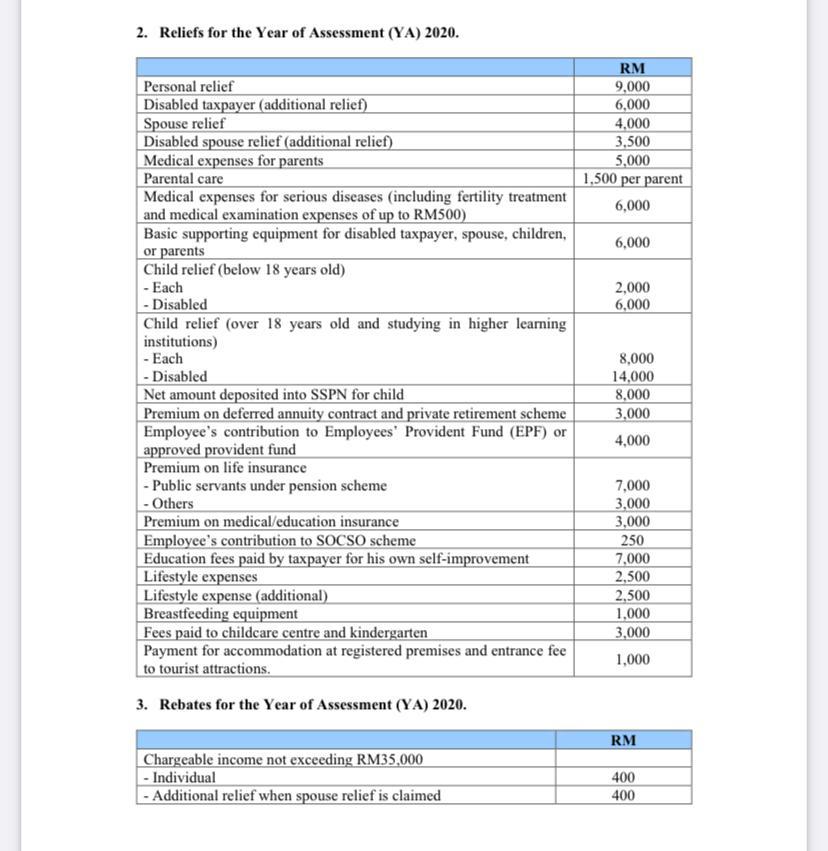

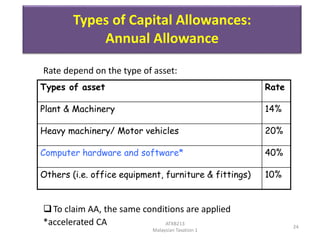

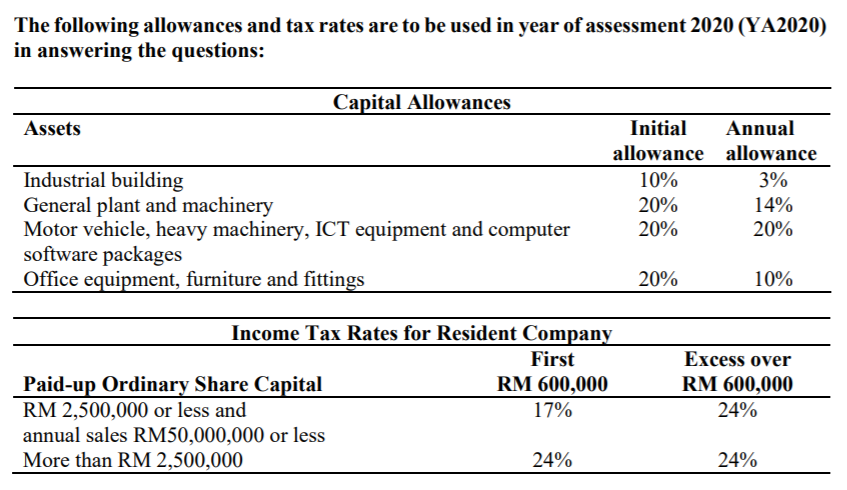

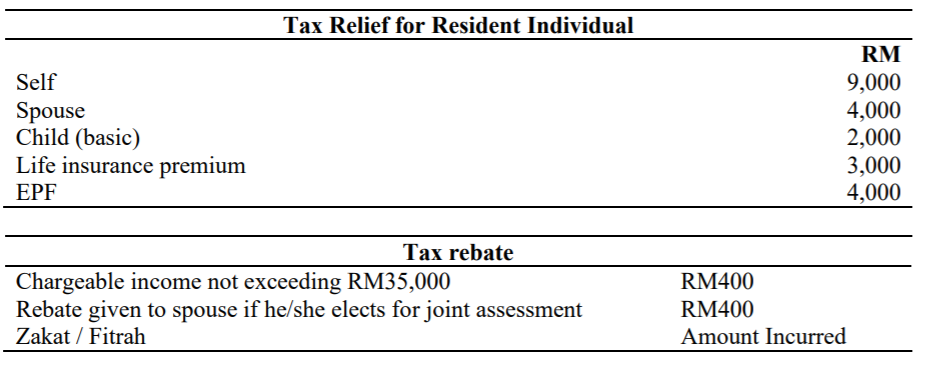

15 April 2013 CONTENTS Page. Type of Asset Initial Allowance Annual Allowance. Income Exempt From Tax.

Claim capital allowances under paragraphs 10 and 15 of Schedule 3 of the ITA in respect of the said assets. Double tax incentives capital allowance green investment tax allowance. 8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to.

Claims for capital allowance can be made in the relevant column provided in the Return Form. Box 10192 50706 Kuala Lumpur. Since April 2009 the rules were changed by Finance Act 2009 for cars purchased from 1 April 2009 6.

The rules allow for ca to be fully claimed on the development cost of customised software over four years by a resident person in malaysia based on an initial. 42013 Date Of Issue. 51 Paragraph 19A Schedule 3 of the ITA provides a special rate of allowance to be given to small value assets instead of the normal rates of capital allowance as provided under paragraphs 10.

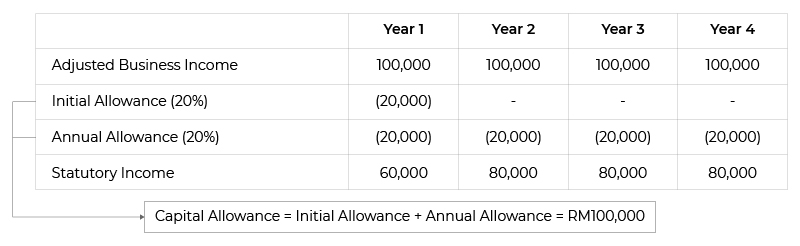

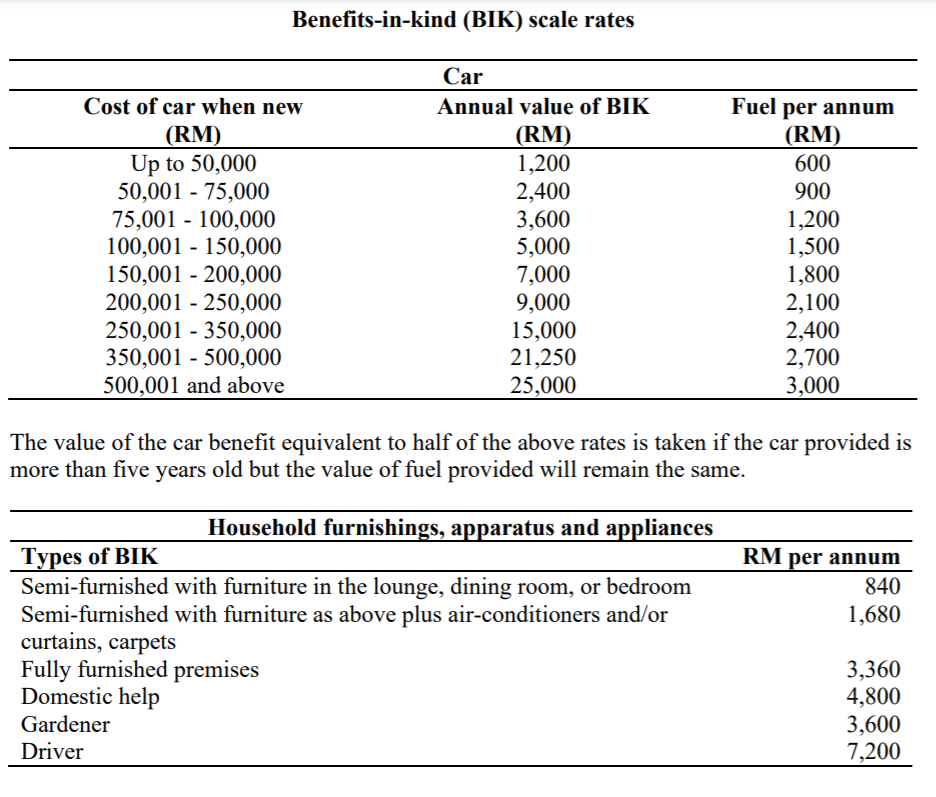

The following are examples of capital allowance rates currently available. However it is desirable that malaysiaâs capital allowance regime be revised to include all business assets so that all such assets are recognised for tax purposes. Capital Allowances Tax Incentives Income Exempt From Tax Double Tax Treaties and Withholding Tax Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax.

In the 2020 Economic Stimulus Package announced on 27 February 2020 it was. Jalan Rakyat Kuala Lumpur Sentral PO. Initial allowance Annual allowance Industrial building whether.

Income Tax Rates and Thresholds Annual Tax Rate. INLAND REVENUE BOARD OF MALAYSIA ACCELERATE CAPITAL ALLOWANCE Public Ruling No. 64 A person is deemed to have elected for special allowances on small value.

The annual allowance on cars costing over 12000 was restricted to 3000. Special rate of capital allowance. Capital allowances consist of an initial allowance IA and annual allowance AA.

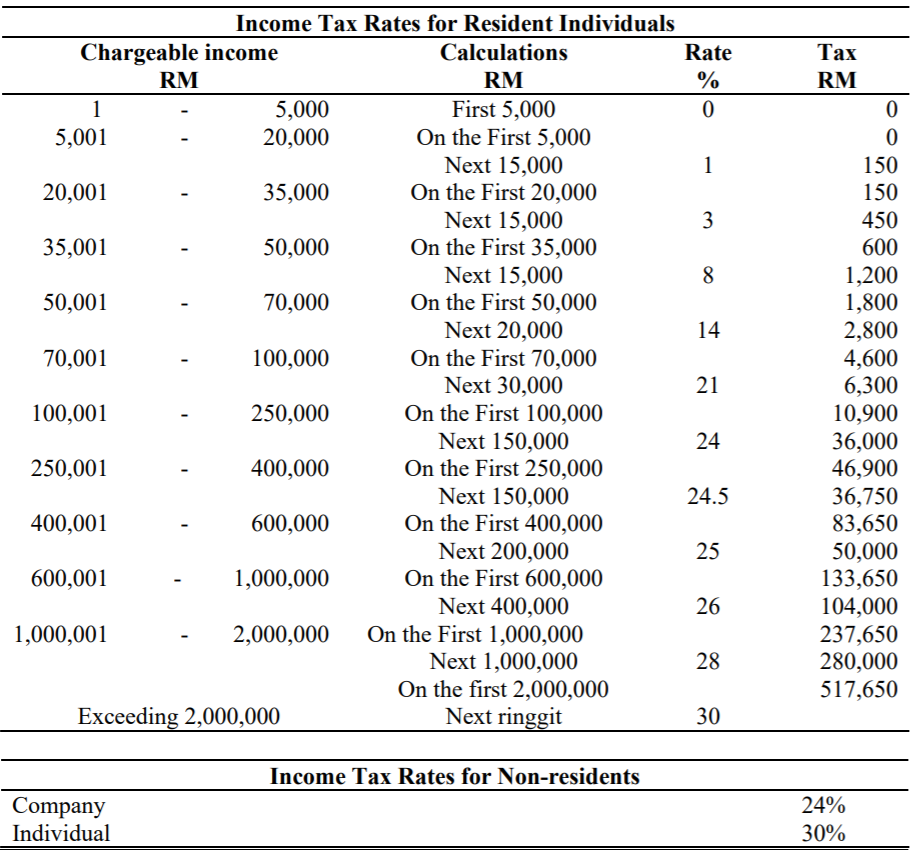

Malaysia Non-Residents Income Tax Tables in 2022. Double tax incentives capital allowance green investment tax allowance. Double Tax Treaties and Withholding Tax Rates.

Relief Options For Current Year Unabsorbed Capital Allowances And Trade Losses Acca Global

5 Capital And Industrial Building Allowances Initial Chegg Com

Chapter 7 Capital Allowances Students

Capital Allowance Calculation Malaysia With Examples Sql Account

5 Capital And Industrial Building Allowances Initial Chegg Com

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Chapter 7 Capital Allowances Students

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Chapter 7 Capital Allowances Students

Chapter 7 Capital Allowances Students

Capital Allowance Calculation Malaysia With Examples Sql Account

The Following Allowances And Tax Rates Are To Be Used Chegg Com

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Relief Options For Current Year Unabsorbed Capital Allowances And Trade Losses Acca Global

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Capital Allowance Calculation Malaysia With Examples Sql Account

Chapter 7 Capital Allowances Students

Chapter 7 Capital Allowances Students

5 Capital And Industrial Building Allowances Initial Chegg Com